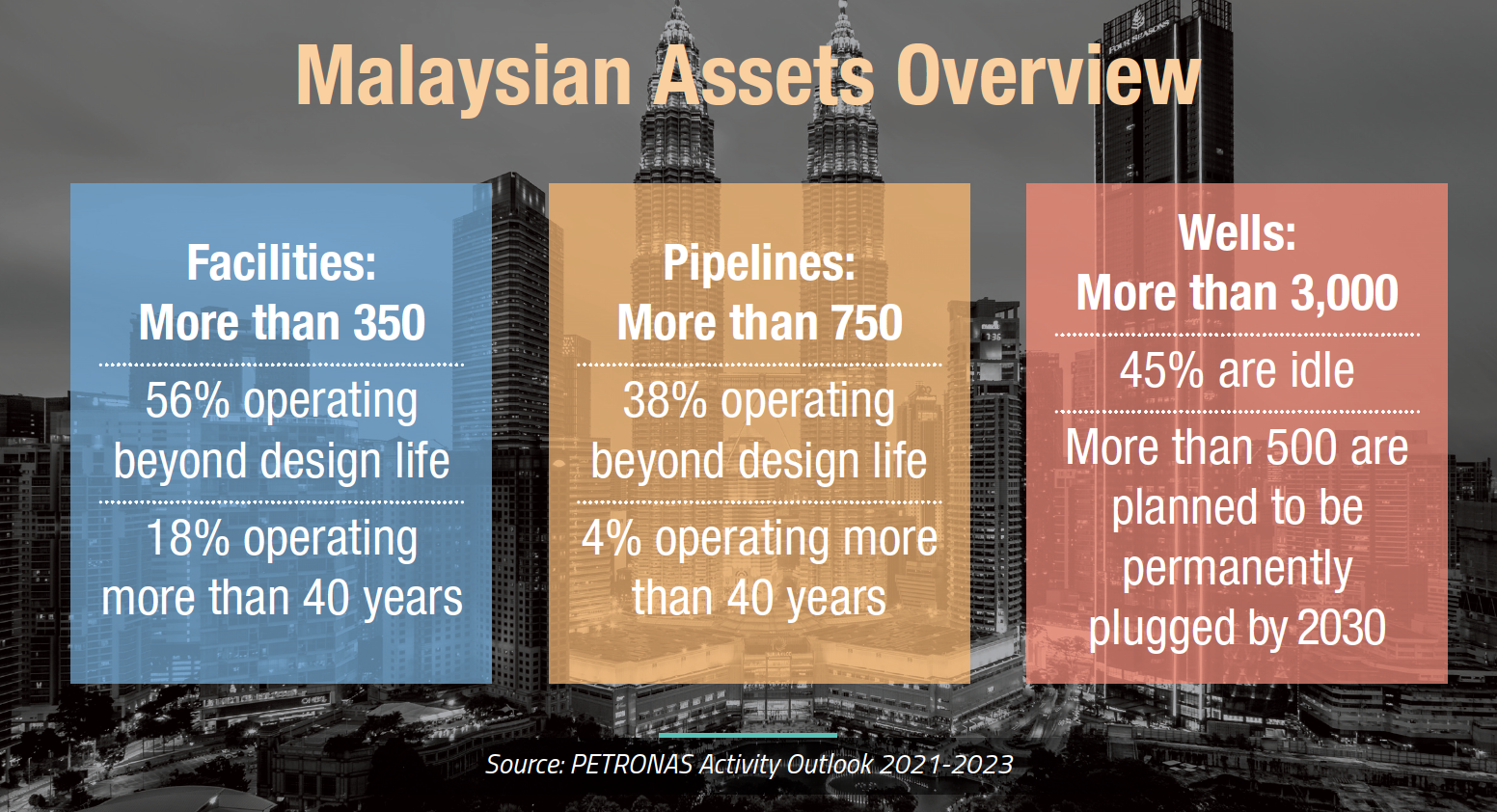

Malaysia by the Numbers

From PETRONAS’ Activity Outlook (2021–2023), here’s the scope of Malaysia’s aging offshore infrastructure:

– Facilities: 350+

– 56% beyond design life

– 18% aged over 40 years

– Pipelines: 750+

– 38% beyond design life

– Wells: 3,000+

– 45% idle

– 500+ targeted for P&A by 2030

Challenges on the Horizon

The report outlines steep hurdles:

– Fragmented and evolving regulatory standards

– Uncertainty over liabilities and cost exposure

– Financing gaps and shortage of skilled resources

– High technical complexity and pressure to reduce environmental impact

Opportunities for the Region

Despite the challenges, Malaysia is already setting a precedent for regional collaboration, innovation, and leadership:

– Major D&A campaigns led by PETRONAS, including FPSO removal, pipeline repurposing, and artificial reefing projects

– Kitar Solutions, a JV between Sapura Energy and AF Offshore Decom, aims to offer end-to-end decom services in Asia

– Local companies like T7 Global and Mermaid Maritime are expanding their portfolios through inspection, ROV, and well abandonment services

– Rigs to Reefs strategy potentially reducing decom costs by up to US$22 million per platform

Looking Ahead: D&A APAC 2024 in Kuala Lumpur

The D&A Asia Pacific 2024 conference (Nov 12–13 in Kuala Lumpur) will gather operators, regulators, and suppliers to review best practices, contracting models, and P&A innovations. This comes at a pivotal moment as Malaysia plans to decommission 137 wells, 31 pipelines, and multiple subsea assets over the next 3 years.

Conclusion

Malaysia’s proactive stance and diverse project portfolio offer a blueprint for the rest of Southeast Asia. But as highlighted in the report, realizing this potential requires long-term planning, policy clarity, and unprecedented collaboration between stakeholders.

Full report available at: https://events.offsnet.com/DAAPAC2024#/Report?lang=en