Why Asia Must Pay Attention Now

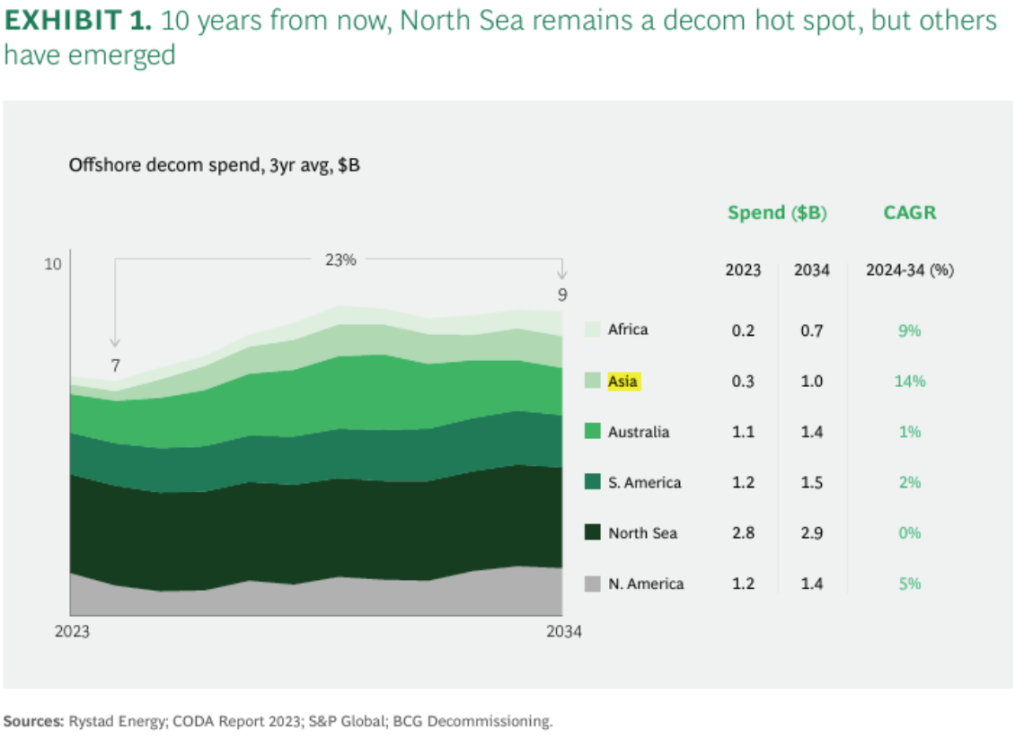

According to BCG, offshore decommissioning is already a $10 billion annual market, with Asia projected to grow from $0.3B in 2023 to $1.0B by 2034, registering the fastest CAGR of 14% globally. With over 2,000 offshore platforms and thousands of aging wells across Southeast Asia, this rapid growth brings both urgency and opportunity.

Pain Points from Mature Basins

Mature regions like the North Sea and Gulf of Mexico expose deep systemic issues that still persist:

– Boomerang liabilities—decom responsibility falling back on previous owners.

– Methane leaks from orphaned wells—estimated at 8.8 million tonnes of CO₂e annually in the U.S.

– Delays and inefficiencies, with up to 50% of platforms missing decom deadlines.

Lesson for Asia: Build solid regulatory safeguards, financial assurance models, and early asset retirement plans to avoid fiscal and environmental risks.

What Works: Six Proven Cost Levers

BCG identifies six levers that consistently reduce decom costs by up to 30%:

1. Fit-for-purpose design & tech

2. Campaign-style execution

3. Specialized decom processes

4. Innovative contracting

5. End-to-end decom teams

6. Lean project governance

Asia’s Unique Challenge: Institutional Knowledge

While the Gulf of Mexico has plugged 25,000+ wells and removed 5,000+ platforms, most Asian NOCs and regulators are navigating decom for the first time.

Action: Establish regional decom platforms, mandate lesson capture, and invest in capacity building across sectors.

The New Cost Risks: Market Volatility & Energy Transition

The report warns that P&A costs could rise >30% if market rates rebound. Rig rates have surged ~50% globally. The energy transition is also pushing early shutdowns, pressuring decom budgets.

Strategic Moves for APAC Operators

From BCG’s operator engagements, these stand out:

– Define cessation-of-production (CoP) timelines.

– Appoint third-party decom operators.

– Use supplier consortiums for scale.

– Align late-life operations with decom for capex-opex efficiency.

Example: In the Netherlands, a 75-well P&A campaign delivered 25% savings via supplier consortium.

Supply Chain: Time to Specialize

For contractors, decom is a chance to lead:

– Invest in rigless P&A tools.

– Build decom-ready vessels.

– Form JV structures for APAC decom access.

Governments: The Missing Link

Governments must go beyond compliance:

– Implement liability in perpetuity

– Mandate decom escrow funds

– Build national decom platforms

– Encourage multi-operator campaigns

Conclusion: Asia at the Tipping Point

The next decade will define how Asia’s offshore legacy is managed. With mature basin lessons at hand, stakeholders must act now. The path to decom excellence lies not just in hardware, but in policy, partnerships, and playbooks proven globally.

Figure: Asia is the fastest-growing decommissioning region, projected to triple its offshore spend by 2034.

Read the full original report at: https://media-publications.bcg.com/BCG-Lessons-from-Mature-Basins-October-2024.pdf